In March 2024, DGRV met with the project partners in Benin and signed two MoUs, one of them with FECECAM-Benin, by far the most important institution with the vision ‘to be a leading reference network in the sub-region for socio-economic development at grassroots level’ with a nationwide presence that has more than 1.3 million members with a total balance sheet of around EUR 200 million EUR. Once the DGRV office is established in the second half of 2024, the focus of the collaboration will be on strategic and organizational advice and training measures, supplemented by promoting the role of women in managerial positions.

DGRV first became active in francophone sub-Saharan Africa in 2021 with the implementation of the regional project Agricultural Finance Africa based in Cameroon, which was extended and merged into the project promotion of cooperative structures in selected African countries in January 2024. In the first phase of the project, contacts were established with key players in the co-operative microfinance sector and with representatives of the banking supervisory authorities in Benin that made it possible to consider deepening partner relationships going forward.

Benin tallies 13.5 Mio. inhabitants with an average age of just over 18 years. The main rating agencies have recently emphasized strong trend growth, a moderate public debt-to-GDP ratio, a series of economic reforms – driven by President Patrice Talon, who was elected for a second term until 2026 – as well as prudent fiscal policy and proactive debt management. Patrice Talon argues in favor of a more autonomous attitude on the part of African governments and states that ‘the African continent is today solely responsible for its underdevelopment’. On the other side, it needs to be noted the rather low – albeit growing – government revenues, a relatively undiversified economy heavily exposed to neighboring Nigeria and the agricultural sector, as well as low development indicators compared to peers.

The high need for investment in the digitalization of products and processes, the lack of long-term financing, maintaining the quality of the loan portfolio at a satisfactory level while coping with external shocks and climate change and the constant need to train bank staff are associated with high costs. The government is helping by providing customized refinancing via the Fonds National de Development Agricole (FNDA) and passing a new microfinance law.

A Project Story of the Month / Team Africa, Holger Grimm

A new partnership between DGRV and the Cooperative Development Authority (CDA) in the Philippines is enhancing regulatory oversight and stability within the cooperative sector.

More

DGRV’s project in Honduras focuses on strengthening the cooperative financial sector, particularly in rural areas, and improving access to financial products and services. The initiative also aims to enhance resilience to climate change and promote the efficient use of natural resources, fostering sustainable and inclusive economic growth.

More

The 8-year long TAKBİ project within the framework of the Turkish and German association cooperation, revitalized Turkish agricultural cooperatives by surmounting challenges, elevating organizational structures, improving service quality, and fostering member satisfaction, leaving a lasting positive impact on the cooperative landscape in Turkey.

More

Financial experts from Benin, Cameroon, and Uganda embarked on a journey to Germany to explore the essence of cooperative principles, forging a vision for a resilient banking sector that transcends borders and fosters economic and social progress in African communities.

More

In an extraordinary gathering, female traditional leaders from Southern Africa converged to harmonize the concepts of Ubuntu and cooperative principles, setting a visionary path for community development.

More

Empowering Cambodia's agricultural cooperatives through dynamic seminars: DGRV and AERD/RUA collaborate to drive leadership, professionalism, and sustainable growth.

More

In June, eight Chilean organizations participated in an Exposure Visit to learn from the experience of Energy Cooperatives in Germany

More

Empowering Mozambican youth through cooperative entrepreneurship to tackle unemployment and promote economic growth.

More

Helping the cooperative CCampo Alimentos to implement an Agrivoltaic pilot project in Brazil

More

Adaptation measures to climate change in rural areas in India

More

Renewable Energy in Costa Rica generated by cooperatives.

More

Food Processing with a Regional Federation

More

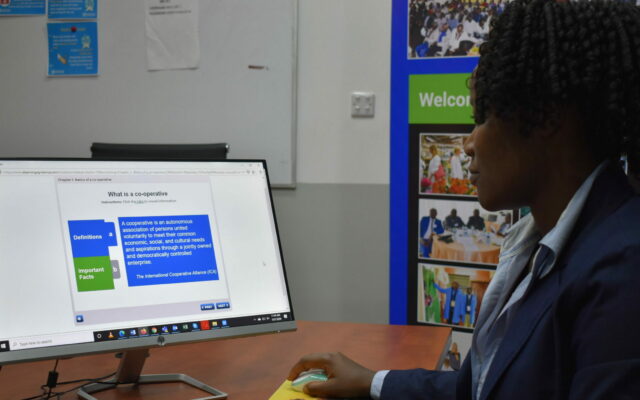

Digitisation of Primary Co-operatives in eSwatini

More

A central solution that enables members to make daily agricultural necessities available promptly and financially affordable

More

The creation of Community Distributed Generation Cooperatives in Chile.

More

Textile cooperative in Tunisia

More

Facilitating access to quality agricultural finance products in Cameroon

More

Generating business and commercial connections with the "Networks in Action" project

More

Mid- term courses for cooperative officials in Vietnam

More

The collaboration between the Brazilian and German cooperative sector

More

DGRV Kenya supports project partners on their way to adapt to “The new normal” in times of COVID-19

More

Pablo and his Potatoes

More

Strengthening small rural producer organizations in Colombia

More

Cooperative Social Responsibility in Honduras

More