Financial institutions in Ecuador are increasingly aware of their impact on the climate and environment. This is not so much about the energy consumption of their offices or the water consumption of their restrooms. No, it is about the impact of their credit portfolio on the environment – the impact of their customers. Through their credit decisions, financial institutions have a major impact on the local economy. Whether it is the bank in the big city or the credit union in the countryside, they decide, what kind of projects will be realized in the future. Until now, the decision for or against a loan project has been based almost exclusively on economic criteria. But this is slowly changing.

Lately, clients seeking financing for an infrastructure project are asked where they reforest the felled trees. Or industrial companies are asked to submit a concept explaining how polluted water is cleaned before it is returned to the river. Several cooperative and commercial banks do this out of their own conviction and have been taking sustainability criteria into account in their lending process for decades. Others are waiting for a law that obliges them to take sustainability criteria into account.

And this law will come! More and more governments are realizing the enormous influence they can exert through the financial sector on the real economy and transform it into a sustainable economy that takes into account the needs of future generations.

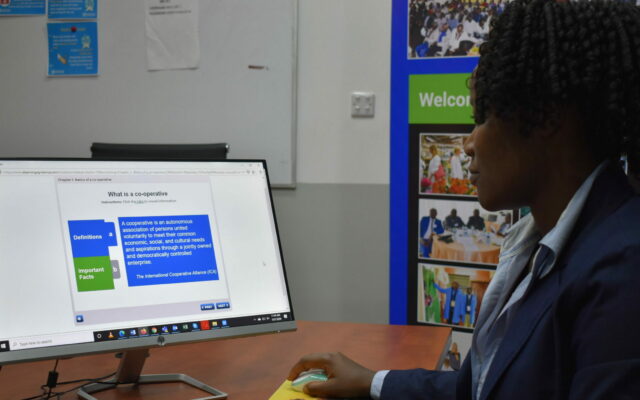

To support Savings and Credit Cooperatives in this transformation process towards a “sustainable cooperative”, DGRV offers several technological tools. With an E-learning course (www.finanzassosteniblesdgrv.com), cooperatives are offered a tool to sensitize their staff on the topic of sustainable finance.

In the course the user learns the differences between sustainable, green and climate finance and how the actions of the cooperative and its members can influence the climate and the environment. It teaches how to find climate change business opportunities for both the credit union and its members. In addition, the user learns the steps for the implementation of a Social and Environmental Risk Analysis System (SARAS) for the management of environmental, climate and social risks.

For Savings and Credit Cooperatives that have already decided to offer green loans, DGRV offers the MicroScore. A sustainable module a tool that allows them to automatically determine whether the loan is green or not. That is, if the loan contributes positively to the climate or the environment. To achieve this, the MicroScore first analyzes whether the activity to be financed is part of the exclusion list (contains activities that are highly harmful to the environment). If it passes the first filter, the credit is evaluated against eligibility criteria.

For five segments (sustainable agriculture and livestock, energy efficiency, renewable energy and transportation), different eligibility criteria were identified for granting or denying sustainable credit.

DGRV Ecuador is currently working on a tool that will allow Saving and Credit Cooperatives to manage environmental, climate and social risks within their credit portfolio. With these DGRV tools, they are prepared for a new era, the era of sustainable finance. Because the impact of climate change will also depend on financial institutions.

A new partnership between DGRV and the Cooperative Development Authority (CDA) in the Philippines is enhancing regulatory oversight and stability within the cooperative sector.

More

DGRV’s project in Honduras focuses on strengthening the cooperative financial sector, particularly in rural areas, and improving access to financial products and services. The initiative also aims to enhance resilience to climate change and promote the efficient use of natural resources, fostering sustainable and inclusive economic growth.

More

The 8-year long TAKBİ project within the framework of the Turkish and German association cooperation, revitalized Turkish agricultural cooperatives by surmounting challenges, elevating organizational structures, improving service quality, and fostering member satisfaction, leaving a lasting positive impact on the cooperative landscape in Turkey.

More

Financial experts from Benin, Cameroon, and Uganda embarked on a journey to Germany to explore the essence of cooperative principles, forging a vision for a resilient banking sector that transcends borders and fosters economic and social progress in African communities.

More

In an extraordinary gathering, female traditional leaders from Southern Africa converged to harmonize the concepts of Ubuntu and cooperative principles, setting a visionary path for community development.

More

Empowering Cambodia's agricultural cooperatives through dynamic seminars: DGRV and AERD/RUA collaborate to drive leadership, professionalism, and sustainable growth.

More

In June, eight Chilean organizations participated in an Exposure Visit to learn from the experience of Energy Cooperatives in Germany

More

Empowering Mozambican youth through cooperative entrepreneurship to tackle unemployment and promote economic growth.

More

Helping the cooperative CCampo Alimentos to implement an Agrivoltaic pilot project in Brazil

More

Adaptation measures to climate change in rural areas in India

More

Renewable Energy in Costa Rica generated by cooperatives.

More

Food Processing with a Regional Federation

More

Digitisation of Primary Co-operatives in eSwatini

More

A central solution that enables members to make daily agricultural necessities available promptly and financially affordable

More

The creation of Community Distributed Generation Cooperatives in Chile.

More

Textile cooperative in Tunisia

More

Facilitating access to quality agricultural finance products in Cameroon

More

Generating business and commercial connections with the "Networks in Action" project

More

Mid- term courses for cooperative officials in Vietnam

More

The collaboration between the Brazilian and German cooperative sector

More

DGRV Kenya supports project partners on their way to adapt to “The new normal” in times of COVID-19

More

Pablo and his Potatoes

More

Strengthening small rural producer organizations in Colombia

More

Cooperative Social Responsibility in Honduras

More