Pablo Lopez who is a farmer in Machachi (one hour from Quito) is part of the third generation in his family whose work is to cultivate potatoes.

Until 2018, Pablo has never needed any loan to buy seeds for his next sowing, until one day, his wife Maria had an accident and Pablo had to pay medical bills for more than $10,000.00. Since his money was not enough to buy seeds, he went to the saving and credit cooperative “cooperativa de ahorro y crédito” (CAC) in his town to request a loan. At the beginning, the cooperative did not want to give him the loan since they did not have much experience in agricultural loans. Since Pablo was already a member of the cooperative for 16 years and well known in the community as a good farmer, the cooperative approved the loan and gave him $5,000.00 (USD) to buy potatoes seeds, under the consumer loan´s conditions, which means with monthly payments.

As every year, Pablo started to sow potatoes in the month of May in order to harvest in November. Referring to his loan payment it was not bad, not good. There were months when it was difficult to pay the monthly payment, because as a farmer, he did not have fixed income every month. But he depended on the harvest and sales of his products and what was worst, the year 2019 was an extraordinary dry year. Due to the lack of rain, the harvest represented only 65% of the average production of the last years. This situation was not enough to pay the last monthly payments. He was on delay with his loan payments and the cooperative was compelled to reestablish his conditions.

What happened to Pablo reflects two problems that many CACs have to deal with. One of the problems is the lack of proper methodologies to provide loans for the agricultural sector. Many CACs process agricultural loans as consumer loans which means monthly payments, but farmers only have incomes during the harvest seasons. That is every 2, 3 or 6 months, which depends on the cycle of the product planted.

The other big challenge is the climate change that makes every year more difficult to make reliable harvest predictions, which affects directly the capacity estimations of payments to CACs. Agricultural zones with ideal climate to sow coffee during decades, suddenly suffer extreme temperatures that are not good enough to sow coffee, for example, but it may be good for another product. In order to determine the proper product for a specific farm, the Danish Ingemann platform “Agroclimatica” is a great allied.

With funding from GESTE Foundation, DGRV offers to all cooperatives which use the credit-scoring tool of DGRV “Agricultural MicroScore” the use of the free platform “Agroclimatica” during six months. This platform analyzes if the weather, the soil, the crop or cattle, and agricultural practices of a specific farmer, in a specific farm, are right for the production of certain agro industrial products. For this purpose, Agroclimatica works with climate historic data and with 21 international climate prototypes, local soil maps, satellite images, local consultancies and scientific documentation to quantify the agro climatic risk of a loan for a farmer in the selected time.

The platform is calibrated until 2050, so it can evaluate loans and investments in a short, medium and long range. If the platform detects that the farm will have, for example, a little rain, it broadcasts a projection at a ten level of this development. It sends an alert to the credit official and recommends a product adapted to climate conditions of this farm, which let both the credit cooperative and the agro industrial producer to have success in their business. With this tool, the cooperative does not only avoid a payment delay, but also, it could provide the member an alternative to a product with a better performance and a higher climate resilience for his/her farm.

The Agricultural MicroScore is a credit-scoring tool owned by DGRV that estimates the loan amount depending on the productive cycle. In addition, it broadcasts expected incomes depending of the agricultural product and the farming area or livestock unit. In that way, the credit advisor has an estimation of how much the agricultural activity to be financed is going to generate, without being an expert on this matter.

With these two tools, the cooperatives are perfectly prepared to operate in the farming sector and mitigate risks caused by the climate change.

A new partnership between DGRV and the Cooperative Development Authority (CDA) in the Philippines is enhancing regulatory oversight and stability within the cooperative sector.

More

DGRV’s project in Honduras focuses on strengthening the cooperative financial sector, particularly in rural areas, and improving access to financial products and services. The initiative also aims to enhance resilience to climate change and promote the efficient use of natural resources, fostering sustainable and inclusive economic growth.

More

The 8-year long TAKBİ project within the framework of the Turkish and German association cooperation, revitalized Turkish agricultural cooperatives by surmounting challenges, elevating organizational structures, improving service quality, and fostering member satisfaction, leaving a lasting positive impact on the cooperative landscape in Turkey.

More

Financial experts from Benin, Cameroon, and Uganda embarked on a journey to Germany to explore the essence of cooperative principles, forging a vision for a resilient banking sector that transcends borders and fosters economic and social progress in African communities.

More

In an extraordinary gathering, female traditional leaders from Southern Africa converged to harmonize the concepts of Ubuntu and cooperative principles, setting a visionary path for community development.

More

Empowering Cambodia's agricultural cooperatives through dynamic seminars: DGRV and AERD/RUA collaborate to drive leadership, professionalism, and sustainable growth.

More

In June, eight Chilean organizations participated in an Exposure Visit to learn from the experience of Energy Cooperatives in Germany

More

Empowering Mozambican youth through cooperative entrepreneurship to tackle unemployment and promote economic growth.

More

Helping the cooperative CCampo Alimentos to implement an Agrivoltaic pilot project in Brazil

More

Adaptation measures to climate change in rural areas in India

More

Renewable Energy in Costa Rica generated by cooperatives.

More

Food Processing with a Regional Federation

More

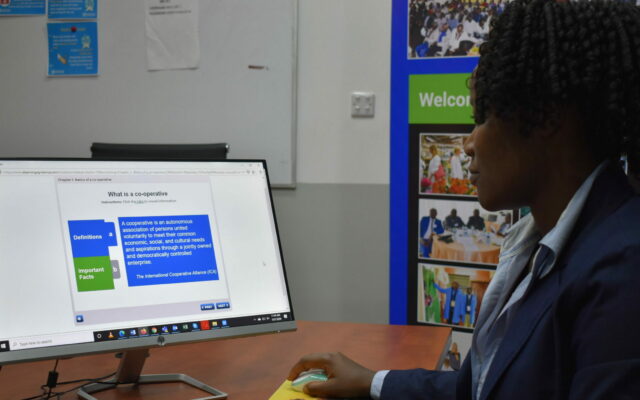

Digitisation of Primary Co-operatives in eSwatini

More

A central solution that enables members to make daily agricultural necessities available promptly and financially affordable

More

The creation of Community Distributed Generation Cooperatives in Chile.

More

Textile cooperative in Tunisia

More

Facilitating access to quality agricultural finance products in Cameroon

More

Generating business and commercial connections with the "Networks in Action" project

More

Mid- term courses for cooperative officials in Vietnam

More

The collaboration between the Brazilian and German cooperative sector

More

DGRV Kenya supports project partners on their way to adapt to “The new normal” in times of COVID-19

More

Pablo and his Potatoes

More

Strengthening small rural producer organizations in Colombia

More

Cooperative Social Responsibility in Honduras

More