For the past 6 years, DGRV has been working in Honduras together with FACACH, the Federation of Savings and Credit Cooperatives of Honduras Ltda. With this partner a large number of activities have already been carried out. Mainly, we support the financial sector and some of the tools developed by DGRV have already been implemented.

In 2018, DGRV started to implement the SEC (Qualitative Evaluation System). A tool that allows evaluating the reasonableness of the internal control system of cooperatives. Likewise, the “SPE” (Strategic Planning System), “SPF” (Financial Planning System) and the tool “MicroScore” were implemented. The last one is a microcredit scoring tool that allows reducing the credit risk of cooperatives, which has been very successful in some cooperatives.

Numerous events, seminars, workshops and joint trainings have been organized for and with FACACH. We have introduced a “Sustainable Finance” program and will continue to train our counterparts in different areas.

All activities are aimed at ensuring that cooperatives in Honduras can offer their members access to sustainable, secure and competitive financial services.

It can be seen that many of DGRV´s tools have already been successfully applied in Honduras and are also being used with a positive response.

The tool that has been most successful in Honduras is the “Cooperative Social Balance”. It is a management tool that compiles quantitative and qualitative results of compliance with cooperative social responsibility. This way it’s possible to evaluate its economic-financial performance during a given period, as for example in the analysis and monitoring of areas for improvement according to cooperative principles. In this way, it becomes a diagnosis that makes visible the social actions in an integral manner, showing also what is inherent to the cooperative work and is part of the social responsibility.

The Cooperative Social Balance evaluates a total of 63 indicators based on international standards that have been adapted and adjusted to the realities of different countries and sectors.

At the end, a report is prepared in the form of a social balance sheet. Each indicator is measured in order to assess whether it meets international standards. A methodologically pre-established range is applied to the result to obtain a parameter that includes three levels:

green – satisfactory, yellow – fair, red – insufficient.

Out of a total of 85 savings and credit cooperatives affiliated to FACACH, Cooperative Social Balance has been implemented in 52 by the end of 2020. We have also successfully introduced the tool in our FACACH counterpart. Based on this large number of cooperatives already using the tool, it can be seen that Cooperative Social Balance is a success story in Honduras.

The aim is now to implement the tool in the remaining cooperatives before the end of the project phase in 2022, thus introducing the Cooperative Social Balance Sheet in a generalized manner in our counterpart FACACH and in the affiliated savings and credit cooperatives. In addition, our counterpart CONSUCOOP, the National Supervisory Council of Cooperatives also addresses the issue of the Cooperative Social Balance Sheet and integrates it as a standard.

In the end, the tool is developed and improved collectively, with the participation of our partners at different levels. Of course, the other DGRV tools (SEC, SPE, SPF, MicroScore) will continue to be applied in Honduras. We hope to be able to continue to create this Cooperative Social Balance success story with other tools as well.

A new partnership between DGRV and the Cooperative Development Authority (CDA) in the Philippines is enhancing regulatory oversight and stability within the cooperative sector.

More

DGRV’s project in Honduras focuses on strengthening the cooperative financial sector, particularly in rural areas, and improving access to financial products and services. The initiative also aims to enhance resilience to climate change and promote the efficient use of natural resources, fostering sustainable and inclusive economic growth.

More

The 8-year long TAKBİ project within the framework of the Turkish and German association cooperation, revitalized Turkish agricultural cooperatives by surmounting challenges, elevating organizational structures, improving service quality, and fostering member satisfaction, leaving a lasting positive impact on the cooperative landscape in Turkey.

More

Financial experts from Benin, Cameroon, and Uganda embarked on a journey to Germany to explore the essence of cooperative principles, forging a vision for a resilient banking sector that transcends borders and fosters economic and social progress in African communities.

More

In an extraordinary gathering, female traditional leaders from Southern Africa converged to harmonize the concepts of Ubuntu and cooperative principles, setting a visionary path for community development.

More

Empowering Cambodia's agricultural cooperatives through dynamic seminars: DGRV and AERD/RUA collaborate to drive leadership, professionalism, and sustainable growth.

More

In June, eight Chilean organizations participated in an Exposure Visit to learn from the experience of Energy Cooperatives in Germany

More

Empowering Mozambican youth through cooperative entrepreneurship to tackle unemployment and promote economic growth.

More

Helping the cooperative CCampo Alimentos to implement an Agrivoltaic pilot project in Brazil

More

Adaptation measures to climate change in rural areas in India

More

Renewable Energy in Costa Rica generated by cooperatives.

More

Food Processing with a Regional Federation

More

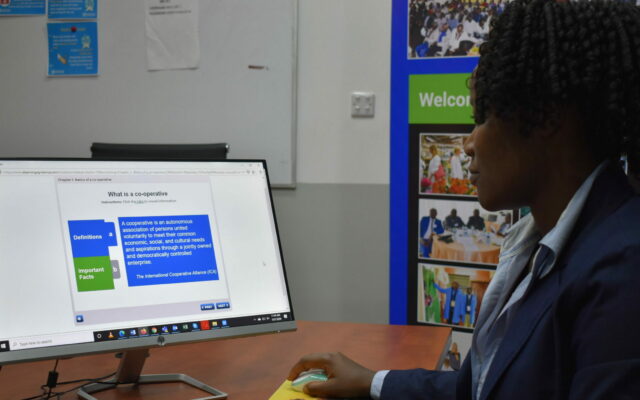

Digitisation of Primary Co-operatives in eSwatini

More

A central solution that enables members to make daily agricultural necessities available promptly and financially affordable

More

The creation of Community Distributed Generation Cooperatives in Chile.

More

Textile cooperative in Tunisia

More

Facilitating access to quality agricultural finance products in Cameroon

More

Generating business and commercial connections with the "Networks in Action" project

More

Mid- term courses for cooperative officials in Vietnam

More

The collaboration between the Brazilian and German cooperative sector

More

DGRV Kenya supports project partners on their way to adapt to “The new normal” in times of COVID-19

More

Pablo and his Potatoes

More

Strengthening small rural producer organizations in Colombia

More

Cooperative Social Responsibility in Honduras

More