Saving and credit co-operatives (SACCOs) are a pillar of the co-operative sector in the landlocked kingdom of eSwatini. While commercial banks are unaffordable or unavailable for a large portion of the often rural population, SACCOs offer access to financial services for the un- and underbanked.

However, many SACCOs rely on pen & paper or outdated, poorly developed systems to run their operations. Not only does this impose risks such as the loss of data; it also makes banking expensive and SACCOs less competitive. Additionally, in a world of increasingly digitalised financial services, the financial gap continues to broaden.

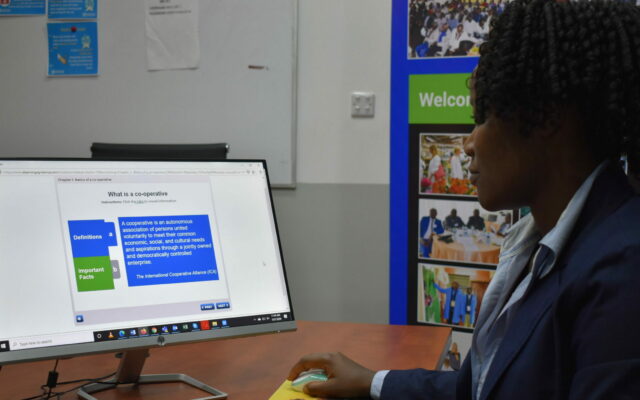

This is where the national apex body of SACCOs, ESASCCO, enters the scene. By providing the core banking system MAMBU to SACCOs in eSwatini and neighbouring countries, ESASCCO enables the primary co-operatives to fully digitalise their operations. Being cloud-based and highly customable as well as allowing for integrations of external systems, SACCOs are now able to offer their members first-class digital banking solutions. As the costs of the service are shared among many primary co-operatives, it becomes affordable for the individual SACCO.

DGRV supports ESASCCO in the provision of MAMBU in various ways to bridge the growth path towards self-sustainability of the project. By contributing to the appropriate equipment with employees, the necessary support for SACCOs – both when adopting the system as well as during the day-to-day operations – is facilitated. A multitude of trainings and workshops empowers the SACCOs to use the system in an optimal way and to collaborate amongst each other. Another key element of the partnership consists of the continuous technical advice on strategy planning and operational implementation. This includes technical and financial support in the further development of the system to suit the needs of the ultimate beneficiary – the members of SACCOs.

Another milestone in the partnership was achieved by jointly positioning ESASCCO as a strategic partner of the company providing the core banking solution. Through highlighting and documenting the impact ESASCCO is creating for members of primary co-operatives, MAMBU has now recognized them as a key partner in achieving their own vision and corporate social responsibility.

Through the service provision by ESASCCO, more than 20 SACCOs in eSwatini, South Africa and Lesotho have digitalised their operations and services. As a result, more than 24,000 members now have access to a broader range of digital financial services. This includes the remote access to their accounts and products including loans which in turn dramatically decreases the costs of banking, e.g. by lowering transport costs. The possibility to communicate with members via the system allow for easier and more timely interaction between co-operatives and their members.

The remote access to the SACCO – both for members and for employees – played a crucial part in sustaining access to financial services during the pandemic. It further significantly contributed to position SACCOs as modern, professional businesses.

The project further impacts the SACCOs by allowing them to professionalize and standardize their business operations which in turn reduces costs for the members. The cloud-based system ensures a high degree of data security and accessibility comparable to that of commercial banks in the global North. By making all transactions and activities traceable, the system actively enhances transparency and accountability towards the members.

As ESASCCO is able to customize the system according to the needs of each individual SACCO as well as to adapt it to future developments, SACCOs now feel better prepared for the future.

A new partnership between DGRV and the Cooperative Development Authority (CDA) in the Philippines is enhancing regulatory oversight and stability within the cooperative sector.

More

DGRV’s project in Honduras focuses on strengthening the cooperative financial sector, particularly in rural areas, and improving access to financial products and services. The initiative also aims to enhance resilience to climate change and promote the efficient use of natural resources, fostering sustainable and inclusive economic growth.

More

The 8-year long TAKBİ project within the framework of the Turkish and German association cooperation, revitalized Turkish agricultural cooperatives by surmounting challenges, elevating organizational structures, improving service quality, and fostering member satisfaction, leaving a lasting positive impact on the cooperative landscape in Turkey.

More

Financial experts from Benin, Cameroon, and Uganda embarked on a journey to Germany to explore the essence of cooperative principles, forging a vision for a resilient banking sector that transcends borders and fosters economic and social progress in African communities.

More

In an extraordinary gathering, female traditional leaders from Southern Africa converged to harmonize the concepts of Ubuntu and cooperative principles, setting a visionary path for community development.

More

Empowering Cambodia's agricultural cooperatives through dynamic seminars: DGRV and AERD/RUA collaborate to drive leadership, professionalism, and sustainable growth.

More

In June, eight Chilean organizations participated in an Exposure Visit to learn from the experience of Energy Cooperatives in Germany

More

Empowering Mozambican youth through cooperative entrepreneurship to tackle unemployment and promote economic growth.

More

Helping the cooperative CCampo Alimentos to implement an Agrivoltaic pilot project in Brazil

More

Adaptation measures to climate change in rural areas in India

More

Renewable Energy in Costa Rica generated by cooperatives.

More

Food Processing with a Regional Federation

More

Digitisation of Primary Co-operatives in eSwatini

More

A central solution that enables members to make daily agricultural necessities available promptly and financially affordable

More

The creation of Community Distributed Generation Cooperatives in Chile.

More

Textile cooperative in Tunisia

More

Facilitating access to quality agricultural finance products in Cameroon

More

Generating business and commercial connections with the "Networks in Action" project

More

Mid- term courses for cooperative officials in Vietnam

More

The collaboration between the Brazilian and German cooperative sector

More

DGRV Kenya supports project partners on their way to adapt to “The new normal” in times of COVID-19

More

Pablo and his Potatoes

More

Strengthening small rural producer organizations in Colombia

More

Cooperative Social Responsibility in Honduras

More