Savings and credit cooperatives play an important role in the microfinance sector in Cameroon, the strongest economy in Central Africa. Most of the 402 microfinance institutions (MFIs) lack the necessary scale to play a vital role in the process of financial inclusion, while commercial banks are still reluctant to penetrate rural areas where about 55% of the total population lives. Around 334 MFIs have chosen the legal form of a cooperative, and approximately 80 % of them are affiliated to two different co-operative Apex institutions, CAMCULL and, more recently, MUFID.

In 1992, the first MUFID was established with a dual objective, both economic and social focusing on agricultural and rural financing and financial inclusion of the disadvantaged population. Three decades later, more than a hundred mutuals are active and cover all ten regions of Cameroon and count a total membership of more than 250,000.

To comply with new regulations, the mutuals transformed their institutions – which originally operated in the legal form of an association – into cooperatives, adopted the name Mutuelle Financière de Développement (MUFID) and organised themselves into a network with an umbrella association, which started operating in 2020.

The partnership between MUFID Union and DGRV aims at facilitating access to quality agricultural finance products and services for its members. DGRV’s intervention follows a holistic approach as a strategic and organisational advisor for MUFID Union as a “start-up”, focusing on the selection process of a core banking solution, the development of products and services for agricultural value chains and the elaboration of tools and procedures for the periodic and permanent control system. Furthermore, the focus lies on the profiling of key elements of corporate governance and risk management.

The establishment of a centre of competence for agricultural finance has been started to act as an operational platform to secure sustainable agricultural financial services for the members. Procedures and guidelines are being developed to ensure the proper implementation of a sound periodic and permanent control system as a basis for a viable governance of the entire organisation. These measures are embedded in several related education and training programs to support a sustainable approach.

A major shift in the way everyone and everything works is expected.

MUFID will digitalise their operations and services providing access to more sophisticated products even at far-off locations. The client portfolio – not well exploited neither fully known by its potential – should become more profitable. It can be expected that the volume of bad loans declines. Members with a strong foothold in their communities of origin, but living in urban areas, may now want to open accounts and start doing business with the “new” MUFID. The core banking solution will allow for easier and more timely interaction between MUFID and their members and make payment services more secure, transparent, and accountable. It contributes to position MUFID as a modern MFI, attractive likewise for new members as well as employees. Market or regulatory changes may be supervised by MUFID Union throughout its corporate centre functions.

If the cooperative business model of MUFID displays its resilience against intrinsic crisis and market turmoil in the future, a discussion with the banking authorities to adapt for a more risk-orientated approach towards the cooperative sector may be engaged. However, the envisaged changes will not happen overnight and may take a lot of patience to achieve.

A new partnership between DGRV and the Cooperative Development Authority (CDA) in the Philippines is enhancing regulatory oversight and stability within the cooperative sector.

More

DGRV’s project in Honduras focuses on strengthening the cooperative financial sector, particularly in rural areas, and improving access to financial products and services. The initiative also aims to enhance resilience to climate change and promote the efficient use of natural resources, fostering sustainable and inclusive economic growth.

More

The 8-year long TAKBİ project within the framework of the Turkish and German association cooperation, revitalized Turkish agricultural cooperatives by surmounting challenges, elevating organizational structures, improving service quality, and fostering member satisfaction, leaving a lasting positive impact on the cooperative landscape in Turkey.

More

Financial experts from Benin, Cameroon, and Uganda embarked on a journey to Germany to explore the essence of cooperative principles, forging a vision for a resilient banking sector that transcends borders and fosters economic and social progress in African communities.

More

In an extraordinary gathering, female traditional leaders from Southern Africa converged to harmonize the concepts of Ubuntu and cooperative principles, setting a visionary path for community development.

More

Empowering Cambodia's agricultural cooperatives through dynamic seminars: DGRV and AERD/RUA collaborate to drive leadership, professionalism, and sustainable growth.

More

In June, eight Chilean organizations participated in an Exposure Visit to learn from the experience of Energy Cooperatives in Germany

More

Empowering Mozambican youth through cooperative entrepreneurship to tackle unemployment and promote economic growth.

More

Helping the cooperative CCampo Alimentos to implement an Agrivoltaic pilot project in Brazil

More

Adaptation measures to climate change in rural areas in India

More

Renewable Energy in Costa Rica generated by cooperatives.

More

Food Processing with a Regional Federation

More

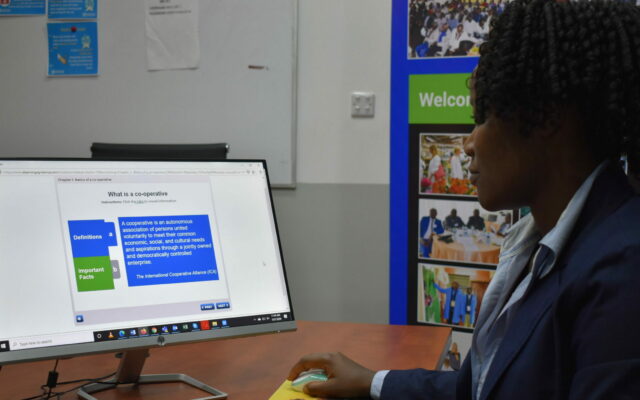

Digitisation of Primary Co-operatives in eSwatini

More

A central solution that enables members to make daily agricultural necessities available promptly and financially affordable

More

The creation of Community Distributed Generation Cooperatives in Chile.

More

Textile cooperative in Tunisia

More

Facilitating access to quality agricultural finance products in Cameroon

More

Generating business and commercial connections with the "Networks in Action" project

More

Mid- term courses for cooperative officials in Vietnam

More

The collaboration between the Brazilian and German cooperative sector

More

DGRV Kenya supports project partners on their way to adapt to “The new normal” in times of COVID-19

More

Pablo and his Potatoes

More

Strengthening small rural producer organizations in Colombia

More

Cooperative Social Responsibility in Honduras

More