Paraguay, this small country in the South of Latin America with only seven million inhabitants hides a dynamic and growing cooperative sector. 11.7% of the financial-banking sector corresponds to the cooperative sector, and with that Paraguay is in third place in Latin America. In agricultural production, 72% of the milk and 24% of the meat export is produced by the cooperative sector and that is where DGRV supports the improvement of the competitiveness.

Coopeduc Ltda. is an institution that impacts the lives of 76,500 associates in 4 departments of the eastern region of Paraguay. This cooperative is part of the „Enlace“ Network promoted by DGRV to offer microfinance services to SMEs and small farmers. In the small city of Iturbe with its 5.000 inhabitants, it supports for example Carlos Ayala, a small producer of maracuja.

The production of this fruit is the result of a productive reconversion program that DGRV has been supporting since 2017. It followed the closure of the region’s main industry of processing sweet cane to manufacture sugar and alcohol. Since then, the cooperative has financed small former sugarcane growers to support them along with agricultural technical assistance in their crop reconversion. That way, famers were able to diversify their income.

The credit of Coopeduc is analyzed by DGRVs tool for microcredit risk analysis „MicroScore“. Currently, the project is evaluating the collection of the fruit, the freezing procedure and the processing. Ultimately, the refined product is used as an extract for juices, ice cream or yoghurts.

In addition to promoting the agricultural reconversion from sugar cane to the maracuja chain, the Coopeduc cooperative has also good knowledge in risk management. Adolfo Balbuena, its general manager, presents the financial performance of his cooperative to its leaders and managers using the DGRV tool “Alerta Temprana”. Currently, more than 180 of the country’s major credit unions report their financial information to the supervisory agency INCOOP through this financial monitoring tool. Adolfo actively participates in the technical roundtables supported by DGRV, such as on the issue of integrated risk management. DGRV has presented to this management group and to the supervision entity INCOOP the proposal for the modification of the regulatory framework in order to simplify the reporting for the risk monitoring by this supervision entity.

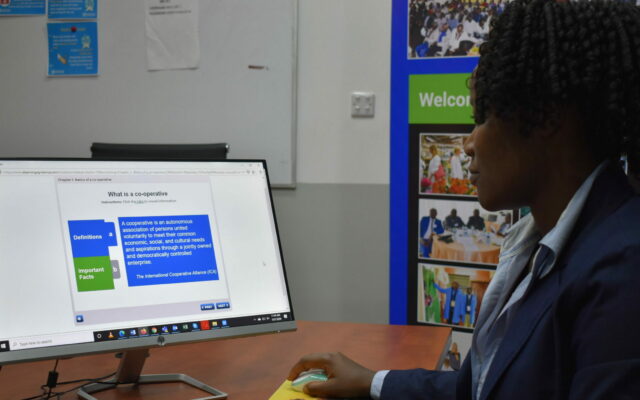

The cooperative will be able to continue supporting its community following appropriate risk management and control standards. With this idea, Javier Castro, internal auditor of Coopeduc, participates in the blended-learning course on internal audit and risk management that DGRV develops. “The course has been very useful since it allows us to contribute to the effectiveness and efficiency of governance processes, risk management and control of Coopeduc“, he said. The course for auditors currently has a total of 37 participants from 27 cooperative institutions in Paraguay.

Within the framework of the national system of cooperative education, the leaders of Coopeduc must obligatorily cover 20 hours of curricular training per year. This system is the result of cooperation between DGRV and the Paraguayan Confederation of Cooperatives (CONPACOOP). Within the framework of this system, nearly 4,200 participants were trained in 2019.

Advice on strategic management to cooperatives

“We value this and other DGRV tools very much and we believe it can contribute a lot to our organization”.

Mr. César Ruiz Díaz is the general manager of the cooperative “Nuestra Señora del Carmen”, a solidarity institution in an urban area that brings together more than 3,200 members of medium to low socioeconomic status, especially women who live in the slums of Asunción and Gran Asunción.

The manager tells us that the methodology has helped to organize the management information and to better reorient the actions of the cooperative towards its target public. The tool provides them with easy-to-interpret inputs to make strategic decisions.

Having professional planning and „MicroScore“ to evaluate credits for micro and small entrepreneurs, SMEs qualified to receive governmental funds (FISALCO). Those funds are specifically opened to finance micro and small businesses to revive the economy affected by the current pandemic.

A new partnership between DGRV and the Cooperative Development Authority (CDA) in the Philippines is enhancing regulatory oversight and stability within the cooperative sector.

More

DGRV’s project in Honduras focuses on strengthening the cooperative financial sector, particularly in rural areas, and improving access to financial products and services. The initiative also aims to enhance resilience to climate change and promote the efficient use of natural resources, fostering sustainable and inclusive economic growth.

More

The 8-year long TAKBİ project within the framework of the Turkish and German association cooperation, revitalized Turkish agricultural cooperatives by surmounting challenges, elevating organizational structures, improving service quality, and fostering member satisfaction, leaving a lasting positive impact on the cooperative landscape in Turkey.

More

Financial experts from Benin, Cameroon, and Uganda embarked on a journey to Germany to explore the essence of cooperative principles, forging a vision for a resilient banking sector that transcends borders and fosters economic and social progress in African communities.

More

In an extraordinary gathering, female traditional leaders from Southern Africa converged to harmonize the concepts of Ubuntu and cooperative principles, setting a visionary path for community development.

More

Empowering Cambodia's agricultural cooperatives through dynamic seminars: DGRV and AERD/RUA collaborate to drive leadership, professionalism, and sustainable growth.

More

In June, eight Chilean organizations participated in an Exposure Visit to learn from the experience of Energy Cooperatives in Germany

More

Empowering Mozambican youth through cooperative entrepreneurship to tackle unemployment and promote economic growth.

More

Helping the cooperative CCampo Alimentos to implement an Agrivoltaic pilot project in Brazil

More

Adaptation measures to climate change in rural areas in India

More

Renewable Energy in Costa Rica generated by cooperatives.

More

Food Processing with a Regional Federation

More

Digitisation of Primary Co-operatives in eSwatini

More

A central solution that enables members to make daily agricultural necessities available promptly and financially affordable

More

The creation of Community Distributed Generation Cooperatives in Chile.

More

Textile cooperative in Tunisia

More

Facilitating access to quality agricultural finance products in Cameroon

More

Generating business and commercial connections with the "Networks in Action" project

More

Mid- term courses for cooperative officials in Vietnam

More

The collaboration between the Brazilian and German cooperative sector

More

DGRV Kenya supports project partners on their way to adapt to “The new normal” in times of COVID-19

More

Pablo and his Potatoes

More

Strengthening small rural producer organizations in Colombia

More

Cooperative Social Responsibility in Honduras

More